Sudan’s central bank governor says taming inflation remains a priority

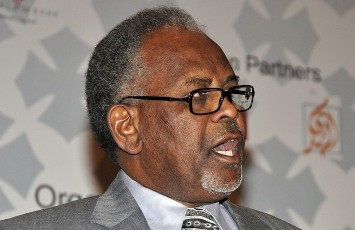

February 25, 2011 (KHARTOUM) – The governor of Sudan’s central bank Sabir Mohamed Al-Hassan said that curbing the soaring inflation in the economy is one of the main objectives for the top financial authority.

He alleged that speculations over the political future of the North after the South breaks away have led to deterioration of the exchange rate and increase in inflationary pressure which impacted the cost of living for ordinary citizens.

The central bank has been implementing a set of measures comprised of a mix of monetary policies and exchange rate policies through reducing demand for hard currency to remedy the unfavorable balance of payments and control inflation.

Al-Hassan said that the central bank has been utilizing tools such as increasing the required reserves kept by the banks from 8% to 11% and conducting open market operations to draw up the excess liquidity in the economy.

The outcome was a reduction of inflation rate to single digit last November, he said.

However, the central bank governor said that recent measures adopted by the government which cut subsidies on sugar and petroleum products could reverse the achievement reached in this regard. Al-Hassan also stressed that low agricultural and industrial production also contribute to inflation.

The North stands to lose billions of dollars in revenue from oil produced mostly in the South. Under a 2005 peace accord both sides equally split the proceeds of the exports from the oilfields.

(ST)