World Bank praises Sudan currency exchange process

October 7, 2007 (KHARTOUM) — The World Bank has praised the success of the introduction of new unified currency in the Sudan. The international body said today the new pound would result in greater efficiency and enhanced stability of the financial system.

“The introduction of the new unified national currency has largely been successful,” said Asif Faiz, World Bank Country Manager for Sudan, at a press briefing held today at the World Bank Office in Khartoum. Faiz said the new Sudanese Pound (SDG) has widely been distributed nation-wide, including Southern Sudan. The new currency had been accepted by the financial sector, and would result in greater efficiency and enhanced stability of the financial system.

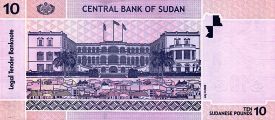

The project fulfilled a key requirement of the CPA, namely that the Central Bank of Sudan introduce a new unified national currency during the Interim Period to replace the multiple currencies that are currently in circulation in the country. This requirement is spelled out in Article 14 (9) of the Wealth Sharing Agreement of the CPA.

At the beginning of the exercise, the currency situation in the country was complex, creating serious problems for the economy. Before the signing of the CPA, the Sudanese dinar has been the legal tender (since 1992) in the areas controlled by the Government of Sudan. In most of Southern Sudan, however, several currencies co-circulate in various locations and combinations: for example, the “old” Sudanese pound, Kenyan and Ugandan Shillings, Ethiopian Birr, US Dollar, and the Sudanese dinar. This situation created real problems for the pricing system and the payment system, generated varying local exchange rates, and was not conducive to the reconstruction and economic re-integration and development of Southern Sudan.

“Introducing a new currency is always a challenge for any country,” said Samuel Munzele Maimbo, Sr. Financial Sector Specialist at the World Bank, “Sudan must be congratulated for being able to do this effectively in Africa’s largest country.”

Maimbo was visiting Sudan as part of the World Bank Review Mission that was in the country over the period of September 24 – October 7, 2007 to review the implementation of the New Unified National Currency Project.

The main objective of the mission was to assess: (i) the progress being made towards achieving the project’s development objectives; (ii) the status of implementation of project’s components; (iii) the status of the fiduciary safeguards for the project, notably financial management and procurement arrangements, particularly in Southern Sudan.

The team held discussions, both in Khartoum and Juba, with implementing agencies of various components of the project. In Khartoum, the mission met with officials at the Central Bank of Sudan responsible for the currency exchange (including members of the National Currency Committee), the Sudan Currency Printing Press, the Sudan Mint Company, the Auditor General’s Office and the National Bank of Abu Dhabi. In Juba, the mission met officials of the Bank of Southern Sudan, which is a branch of the CBoS, commercial banks and international development partners.

In these discussions, the mission reviewed the number of banknotes and coins produced and distributed to the CBoS branches, commercial banks and exchange centers for purposes of the exchange, the actual notes and coins of the Sudanese dinar and foreign currencies that have been withdrawn from circulation and how these have been disposed of. The mission also sought to understand the control procedures followed in the currency exchange program so as to ensure that the risk of fraud was mitigated. In addition, the mission reviewed the financial monitoring, auditing and evaluation aspects of the project.

Overall, the mission was satisfied with its findings. It noted that in many areas, the Central Bank of Sudan had followed international best practice. But it also acknowledged that there were a number of challenges that for unique to Sudan. For example, the presence of a number of foreign currencies in Southern Sudan whose economy is closely linked to economies of Sudan’s neighboring countries. The government has largely managed to exchange these currencies for the new currency. However, as is expected in many border towns around the world, some of the neighboring currencies are likely to be held for trade purposes for sometime to come.

The mission was also pleased to note that the development community was in the process of implementing their financial commitments to the project. Of the total cost of the project was an estimated US$150 million, the development community had initially committed to contributing US$30 million to the exchange process. Of this amount, approximately US$21 million had been disbursed to the government. In the course of the exchange, an additional US$7.36 million was committed to the project. The total development partner contribution is therefore expected to amount to an estimated US$40 million.

Speaking at the meeting, Faiz emphasized that, “The currency exchange process has been a Sudanese success story – designed, developed and implemented by the Sudanese people through the Central Bank of Sudan. The Financial and technical support provided by the development community, through the Multi-donor Trust Fund, which is managed by the World Bank, was designed to support that success.’

(ST)