South Sudan Central Bank opens branch at Uganda border

March 28, 2024 (JUBA) – The Central Bank of South Sudan has opened a branch at the border with Uganda, presenting an opportunity for local employment and facilitating financial services.

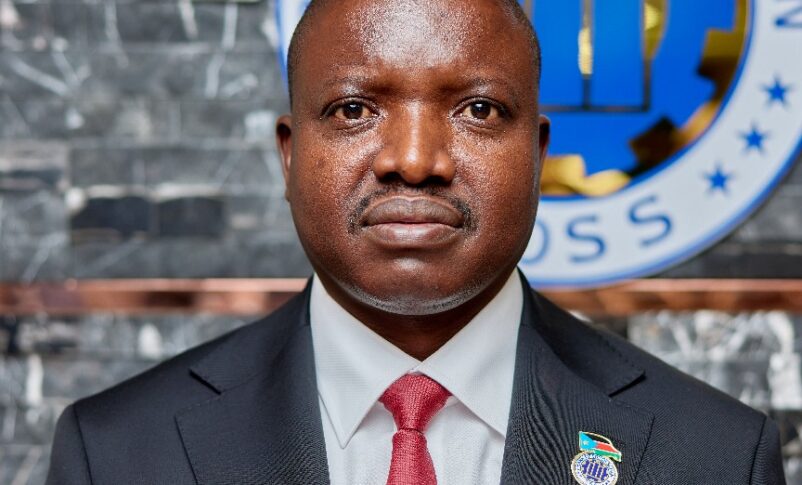

The inauguration ceremony was witnessed by the Central Bank governor, James Alic Garang who was accompanied by the first undersecretary at the Finance and Economic Planning ministry on March 23.

The governor of Eastern Equatoria state, Louis Lobong Lojore, and members of his administration as well as senior officials of the bank and local leadership attended the function in which senior and local officials gave speeches emphasizing production and provision of services to the lower level.

Also present were, William Anyuon Kuol, National Minister of Trade and Industry, Samuel Yanga, First Deputy Governor of the Central Bank of South Sudan, Benjamin Ayali, undersecretary for Planning at the Ministry of Finance and Economic Planning, Africano Mande, Commissioner General of the National Revenue Authority, Brig. General and Commissioner of customs, Aduot Ajang Aduot.

Alic explained that the opening the branch of the Central Bank at Nimule will serve as several windows for clients as importing agents will make direct deposits into the government accounts before getting clearance, thereby boosting the revenue collection, and ensuring greater efficiency in tax performance.

“The presence of the Bank of South Sudan branch in Nimule is crucial in reducing risks related to collection, ensuring timely revenue mobilization, reducing bureaucratic red tape, stemming wastages, and expediting transactions as agents shall deal directly with the branch employee. Broadly, the direct widow for revenue collection will reduce transaction costs, lure more financial services to the area, and empower both individual businesses in the country and the state in general”, he said.

Alic said the branch will play a pivotal role in facilitating trade, commerce, and interaction between South Sudan and our regional and international trading partners, necessitating a need to bring essential financial services nearer to the people as well as fostering financial inclusion by offering loans to farmers and other scale business at the periphery of the society in Eastern Equatoria state.

Garang pointed out that the opening of the branch of the central bank will bring not only financial services to the area but will also create jobs for the local people.

He asked the audience at the inauguration to contextualize the opening of the bank and relate it to the ongoing economic shocks that point to the lack of economic diversification and the insignificant nature of our revenue collection.

South Sudan, Alic said, was experiencing a fiscal crisis, requiring authorities to roll out strategies to address it. one of the strategies is encouraging local production.

“What we experience today is a fiscal crisis, largely originating from insufficient collection and over reliance on oil. To end this, improving local production while raising sufficient tax proceeds to meet government obligations remains key towards economic recovery”, he said.

South Sudan depends largely on the oil with pipelines taking it to the international market for sale passing through Sudan. With the war in Sudan and disruption in the flow, officials are getting concerned with the fate of the budget tied to the oil, causing them to call on the local people to embrace farming and move away from relying on oil.

Alic advocated for investments in sectors like animal husbandry and fishing, along with hospitality and tourism, including religious, cultural, and historical, seem most likely to reap benefits, citing the introduction of revenue-enhancing measures.

These include measures such as value-added tax at a comparatively higher rate compared to other nations, along with excise and legislated taxes on specific goods and services at purchase.

Diversification away from oil would benefit from the size of the country as well as having relatively closed sectors although with relatively low levels of tariff

(ST)