South Sudan swipes at World Bank, IMF loan requirements

May 30, 2024 (JUBA) – South Sudan has described as subjective the debt sustainability analysis conducted by the International Monetary Fund (IMF) and the World Bank to ascertain whether a country qualifies for a loan.

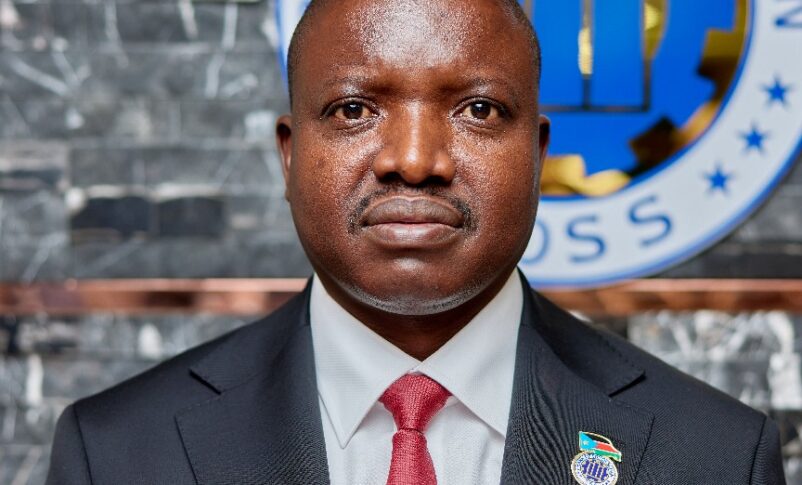

Central Bank governor, James Alic Garang said these conditions limit the ability of African countries to borrow more resources from these two financial institutions.

“We find that time and again most countries are either under debt distress or at risk of high debt distress and because of that the access of these countries to resources is restrained. So, we believe this is something we will keep pushing, and one day we shall have our rating or we shall have more voice at the global financial table because even at the movement in the global setting, there are tables where Africa does not sit on the table”, he explained.

Garang vowed to raise the issue at the plenary meeting of the African Development Bank (ADB) taking place in Nairobi, Kenya from May 27-31, 2024.

South Sudan is currently facing financial challenges to meet its obligation after a large portion of the oil flowing through Sudan to the international markets for sale has been disrupted by a rupture in the pipeline and blockage by the activities of armed groups on the Red Sea. the Yemen-based armed Houthis have threatened to block ships using international water bodies with cargoes.

South Sudan has failed to regularly pay the military and civil servants due to large amounts of money it owes other countries and international financial institutions.

The East African nation, for instance, owes the World Bank $79 million obtained on International Development Association (IDA) terms in 2020, $28 million to the ADB and $150 to the Chinese Exim Bank for the upgrade of Juba International Airport.

After defaulting on a $627 million loan borrowed from Qatar National Bank (QNB), an international court has tasked South Sudan to the pay Qatar bank $1 billion.

Debt and sustainability analysis is a tool by which the International Monetary Fund and the World Bank assess the current debt situation, its maturity structure, whether it has fixed or floating rates, whether it is indexed, and by whom it is held.

It is also a framework used to Identify vulnerabilities in the debt structure or the policy framework far enough in advance to introduce policy corrections before payment difficulties arise. In cases where such challenges have emerged, or are about to emerge, examine the impact of alternative debt-stabilizing policy paths.

According to the IMF and World Bank, the framework consists of two complementary components: the analysis of the sustainability of total public debt and that of total external debt.

(ST)