Sudan says local currency exchange market under control

June 6, 2010 (KHARTOUM) — The governor of Sudan Central Bank today expressed confidence that measures taken to avert the sharp drop in the value of the pound against the dollar helped stabilize the foreign exchange market.

Furthermore, the highest financial authority in Sudan said it will tighten control of exchange bureaux to enforce rules on selling foreign currencies and crack down on the black market as well. The central bank revoked the license of Al-Aroos bureaux last month citing multiple violations of regulations governing the work of trading in foreign currencies.

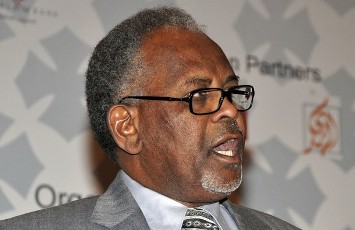

“There was an overshoot [in the pound depreciation]. That is why the central bank started intervening from last week and now things are settling down. We hope that is now contained,” central bank Governor Saber Mohammad al-Hassan was quoted as saying by Reuters.

“We don’t think we need further intervention because it is already now settling down,” he said after a meeting of Arab central bank governors in the United Arab Emirates.

The central bank manages the float of the Sudanese pound. The “indicative” rate is 2.4 pounds to the U.S. dollar, with room for a 3 percent movement in either direction, Hassan said.

On the black market on Sunday, $1 could buy 2.76 Sudanese pounds, compared with 2.85 on Thursday and following a steady rise from 2.60 over the past month. The official rate is 2.28, unchanged from Thursday.

After a period of depreciation the local currency was “relatively stable,” he said in a separate interview with Bloomberg. “It is no longer depreciating at the same rate. We had substantial depreciation around last year and the first two months of this year. Last year, we had depreciation of more than 15 percent”.

Sudan is under US sanctions imposed since 1997 that includes 31 government owned companies which limits their access to US financial system and US dollars. Because of frequent shortages in hard currency, Sudan has restrictions on selling foreign currencies to individuals and entities in excess of what is needed for personal or business needs and also requires heavy documentation to justify it.

The East African country depends on foreign investment from China, India and Gulf Arab states as well as exports of oil. It is sub-Saharan Africa’s third-biggest oil producer, producing about 480,000 barrels of crude a day, according to the BP Statistical Review of World Energy.

Last year the International Monetary Fund (IMF) released a report saying that Sudan had a sharp drop in foreign exchange reserves across the years from $2 billion in mid-2008 to $300 million in March 2009, which covers only 2 weeks of imports for the East African nation.

The IMF said this was caused by the fall in oil prices, which is Sudan’s main export, and the “heavy” intervention by the central bank to sustain the exchange rate. Oil revenue accounts for 80% of cash inflows with the rest coming primarily from foreign investments.

The fast depletion in foreign reserves has prompted Sudan’s central bank to impose a cap on the amount of hard currency available to individuals travelling abroad.

The country has been rebuilding its foreign currency reserves after suffering a “significant” drop, Hassan said in an interview on May 3. Sudan’s foreign-exchange reserves were at $956.2 million in January, according to data compiled by Bloomberg

The central bank governor reaffirmed his country’s intention to drop the pound’s peg to the US dollar and replace it with a basket of international currencies by year’s end.

“We are preparing, we are undertaking the studies and we are choosing the currencies,” Hassan said. “There’s a lot of technical work that will have to go into it” before Sudan announces when the shift will take place, he said.

Hassan cited the U.S. financial and trade embargo on Sudan as one factor behind the decision to drop the dollar tie. “We are not happy with the peg to the dollar because pegging to a single currency is a problem, you subject yourself to problems for no good reason,” he said.

This week, the Euro dropped below $1.20 for the first time in more than four years on worries about Europe’s growth prospects and the effects of government spending cuts being pushed through in the wake of the euro zone debt crisis.

(ST)