Sudan unable to contain rising dollar vs. pound, central bank hikes reserve requirements

June 13, 2010 (KHARTOUM) — Sudan’s central bank this week announced that it asked banks in the country to raise the amount it must hold in reserve from 8% to 11% as the local currency continues sliding against the U.S. dollar.

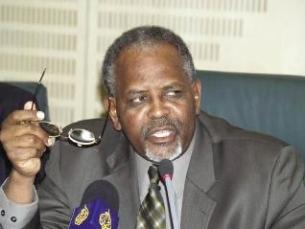

The governor of Sudan central bank Saber Mohamed Hassan said in a statement that the change was made in response “to the fading of the effects of the global crisis on the country’s economy and disappearance of the reasons that led to adopting expansionary policies during the past two years”.

The governor of Sudan central bank Saber Mohamed Hassan said in a statement that the change was made in response “to the fading of the effects of the global crisis on the country’s economy and disappearance of the reasons that led to adopting expansionary policies during the past two years”.

Hassan said while the central bank resorted to injecting cash and reducing reserve requirements, it is now revising its policies into more austerity-oriented one.

Sudan’s banks are now required to maintain 11% of their deposits as reserves, down from 8%, both in local and foreign currencies. Furthermore, the central bank will now withdraw any deposits they made at the commercial banks for the purposes of increasing liquidity.

The only exception will be those banks that received deposits due as part of a bailout package.

In a related subject, Hassan warned banks that they will be held accountable on conforming to regulations relating to foreign exchange expressing hope that the central bank will not carry out crackdowns similar to that took place against exchange bureaux over the last few weeks.

Earlier this month, the central bank said it is injecting more foreign currencies into the market and make it available to banks in order to meet client needs particularly to import goods. It also disclosed that it is tightening control of exchange bureaux to enforce rules.

In one instance the central bank closed down Al-Aroos bureaux citing multiple violations and also froze accounts of individuals suspected of fueling the foreign exchange black market.

The move failed to curb the continued drop in the price of the Sudanese pound against the U.S. dollar as the spread between the official price and that of the black market reached 10%.

The U.S. dollar traded today at 2.60 pounds in the black market as opposed to 2.35 in the official market. Last week the dollar sold for 2.76 pounds in the black market.

Sudan runs a so-called managed float system, in which the central bank calculates an indicative rate based on previous day transactions and intervenes on the market if quotes break away from a plus/minus 3 percent corridor around that rate. The Sudanese pound SDG= indicative rate stood at 2.3019 to the dollar on Sunday, the central bank’s website showed.

Some local economists say that the measures taken by the central bank does not address the root of the problem which centers around a decline in revenue from oil exports which is the main source of hard currency in the country.

The intervention by central bank to correct exchange rates caused a huge drop in foreign exchange reserves from $2 billion in mid-2008 to $300 million in March 2009, which covers only 2 weeks of imports.

Sudan’s foreign-exchange reserves were at $956.2 million in January, according to data compiled by Bloomberg.

Sudan’s economy, under U.S. sanctions since 1997, has been growing by 8 percent on average over the past 10 years on oil exports and foreign investment. But the sanctions have forced the central bank to move its reserves away from U.S. dollars into a basket of other currencies.

The central bank said this month that it will complete a conversion later this year from pegging the pound to the dollar into a basket of other currencies.

(ST)

Ahmed Chol

Sudan unable to contain rising dollar vs. pound, central bank hikes reserve requirements

It is difficult for you to compete with the US dollar. It is a regulate economy by well educated PhD economists. Saber Mohamed, what is your educational background? Harvard economist? I don’t think so. You can compete with your Khartoum University knowledge man.

Ahmed Chol