South Sudan Central Bank introduces new payment systems

November 30, 2011 (JUBA) – The Central Bank of South Sudan on Wednesday announced it was embarking on a modernisation of the country’s payments, clearing and settlement systems.

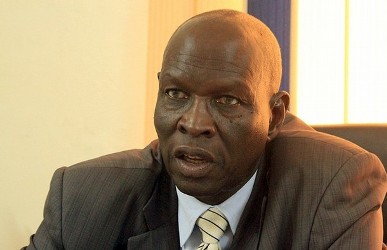

Speaking to reporters at the bank’s board room, Kornelio Koryom Mayiik, the central Bank Governor said the initiative is part of the Central Bank’s strategic vision of modernising the payments and settlement system into one comparable with the rest of the world.

“The system will lower costs, make payments and settlements more accurate and pave the way for increased financial innovations in the country”, Mayiik told journalists.

He said the new process includes the establishment of what he called Real Time Gross Settlement System (RTGS), the Automated Cheque Processing/Automated Clearing House (ACP/ACH), Securities Settlement System (SSS) and an electronic National Switch for retail payments.

The top bank official elaborated that the rationale for the initiative is justified by the fact that South Sudan remains a cash based economy, with payments of large transactions requiring the movement of cash and its attendant risks. The continued dependence on cash payments, he said, also results in delays in cheque processing and inefficiency.

The official noted that the cost of printing currency is quite high, so using plastic cards under the National Switch project would save the nascent nation money. South Sudan became independent less than five months ago and issued it new currency just days after secession from north Sudan.

He added that the Central Bank currently operates a manual cheque clearing system, where commercial banks meet to physically exchange cheques and net balances settled through their current accounts held with the Central Bank, which is time consuming and less efficient in detecting cheque frauds. The delay in confirmation of customer balances due to the lack of real time gross settlement systems results to the acceptance of cheques, which would otherwise be rejected outright.

“Some of these cheques turn out to be dishonored due to various reasons; and the bank has registered insignificant progress in her socio-economic development, simply because it is a consuming country which produces and exports nothing apart from oil. We just became an independent nation. We did not have anything before. So we are trying to consolidate our efforts as bank through the modernisation of the payments system and the creation of a conducive environment for further growth”, he asserted.

The systems when fully functional, he said, will help the Central Bank eliminate or minimize risks associated with payments, clearing and settlement system, eliminate float size for individual customers and banks as well as significantly reduce the float time for cheque clearance, with the possibility of reducing the clearance time from five days to one day in addition to combating fraud and forgery, pave way for reducing high case intensity and gradual migration to high usage of electronic modes of payment, and bring efficiency to government receipts and payments and all other consumers and leverage them for financial deepening of the economy.

“It will also ensure compliance with international principles and standards, especially the core principles for the Systematically Important Payments Systems (SIPS) of the Bank for International Settlement (BIS) and enhance the Central Bank’s monetary management capabilities.

Explaining the techniques behind the initiative, the central bank chief noted that in their quest to ensure the realisation of government’s vision, the Central Bank wishes to harness technology to its advantage and the rest of the financial system. He said the applicable technology in the field of finance enables the elimination of heavy dependence on physical movement of cheques for clearing purposes.

It presents the fastest and most secure mode for clearing cheques through digital means and replaces the physical exchange of cheques between the presenting and paying banks. However, the effectiveness of the system depends largely on how users handle cheques.

He further revealed that the Central Bank will soon embark on a sensitisation process geared towards educating the public on the up-coming plans and the importance of careful handling of cheques.

He also took the opportunity to inform the general public that under the new system, “all cheques payable through our banking system shall be in compliance with specific characteristics, critical among which is the Magnetic Ink Character Recognition (MICR) code.”

The MICR represents a unique code which is inscribed on each cheque leaf and forms the basis of electronic processing. Once the cheque passes through a scanner, an image is generated, which passes through the system electronically for timely confirmation of customer balances and the immediate payment of beneficiaries where applicable.

However, the scanner cannot capture images of damaged cheques, which may result to processing failure. Cheques, he emphasised may be damaged through, writing on the MICR code area, folding of cheques in a form which may prevent its passage through the scanning machine, soiling of cheques with oils, paints or other permanent marks, wear and tear of cheques due to poor storage facilities, stapling of cheques, forgeries aimed at defrauding the system among others.

Governor Mayiik said that all banks would be adequately equipped to implement the new measures. He said he hoped the public would cooperate to help the full implementation of the new payments system.

(ST)

Nuerone Mafitabu

South Sudan Central Bank introduces new payment systems

PUT IN MIND THAT NO ARMY SHOULD ENTER TO THE BANK WITH GUN LIKE THAT DINKA WHO WAS SHOT AT S.S. BANK LAST TIME,AND MORE PHOTOCOPY MONEY IS ON ROAD AND BANKS.

LET THEM STOP THAT.