South Sudan’s announcement of $8 billion loan from China draws skepticism

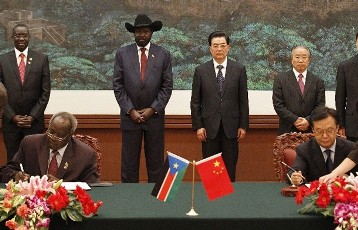

May 15, 2012 (WASHINGTON) – The announcement made by South Sudan last month of an $8 billion loan from China appears to have been overblown, according to officials in Juba as well as diplomats.

But Chinese officials at the time maintained silence and refused to confirm or deny Benjamin’s assertions.

South Sudan’s central bank governor said Kornelio Koriom Mayik acknowledged that they have only secured a tiny fraction of the loan.

“At the moment what has been concluded and signed is in the region of $170 [million],” Mayik told the Financial Times (FT).

He further revealed that South Sudan has obtained a $100 million credit line from Qatar National Bank (QNB) and is discussing a further $500 million deal with “a bank in the Gulf.”

Mayik also confirmed that Beijing rejected Juba’s plea for financing an oil pipeline as an alternative to the one passing through Sudan’s territories.

“The Chinese didn’t agree to build a new pipeline; they said ‘we built one [in the

north already]; you use it” he added.

South Sudan inherited three-quarters of the oil when it gained independence from its northern neighbour last July. But Juba can only export is oil through the north’s pipelines. The two countries have failed to reach an understanding on oil transit fees.

Effective earlier this year South Sudan shut down its entire oil production to stop Khartoum from taking oil to make up for what it calls unpaid fees for transit and use of its facilities.

Both countries were dependent on oil revenues but South Sudan in particular, which is considered the poorest nation on earth, derived 98% of its income from crude exports.

Officials in Juba assert that they can survive for some time off its cash reserves by curtailing spending and seeking external help while it develop plans for an alternative pipeline to export its oil.

South Sudan is considering building two alternative pipelines, one to a port in Kenya and another through Ethiopia and Djibouti.

But analysts say building a pipeline could take up to four years and it is not clear if the newly independent nation can secure credit in the interim at reasonable rates.

Western diplomats believe the smaller sums on offer from China are towards a new embassy in Beijing and a $150 million preferred supplier credit agreement to revamp the airport in Juba.

“The $8 billion figure seems to have referred to the potential worth of South Sudan and China’s relationship in 10 years’ time, should oil get going again,” said a western diplomat to FT, describing the sum as “an initial wow-factor for the domestic audience”.

The Chinese foreign ministry underscored its willingness to support South Sudan without addressing the issue of financing.

“China fully understands South Sudan as a new country is facing many difficulties and challenges and is willing to offer whatever help China could offer to the South,” the Chinese foreign ministry told the FT. It added that it wanted “more powerful, reputable Chinese companies” to invest in the South.

South Sudan is left with few options to shore up its revenue shortfall. A leaked World Bank briefing obtained by Sudan Tribune this month paints a bleak picture of the economic situation. It projects that the country could run out of cash as early as next July.

Even with the most extreme tightening of belts, South Sudan could only last until December 2013, according to the World Bank.

South Sudan central bank governor admitted that there is truth to the grave projections.

“We are importing nearly everything and we are only drawing on reserves, so of course we have some difficulties,” Mayik said.

“On my calculations unless there are shocks we can go for another seven months without oil,” he said, using foreign reserves “in the region of $1.5bn”.

The World Bank has warned that the local currency could collapse leading to the breakdown of the state.

Inflation in Juba is already rising, fuel is in short supply and the local currency is depreciating on the black market.

“A lot of foreign businesses are weighing up leaving,” an international businessman based in Juba told FT, complaining that the government has raised taxes to an “unacceptable level” after the oil was shut down.

(ST)